Anyone wishing to import a vehicle into Spain must be a permanent resident, own property in Spain or have a rental agreement for a minimum period of one year and hold a Spanish driving licence.

By Nick Nutter | Updated 22 Mar 2023 | Andalucia | Living In Andalucia |

Login to add to YOUR Favourites or Read Later

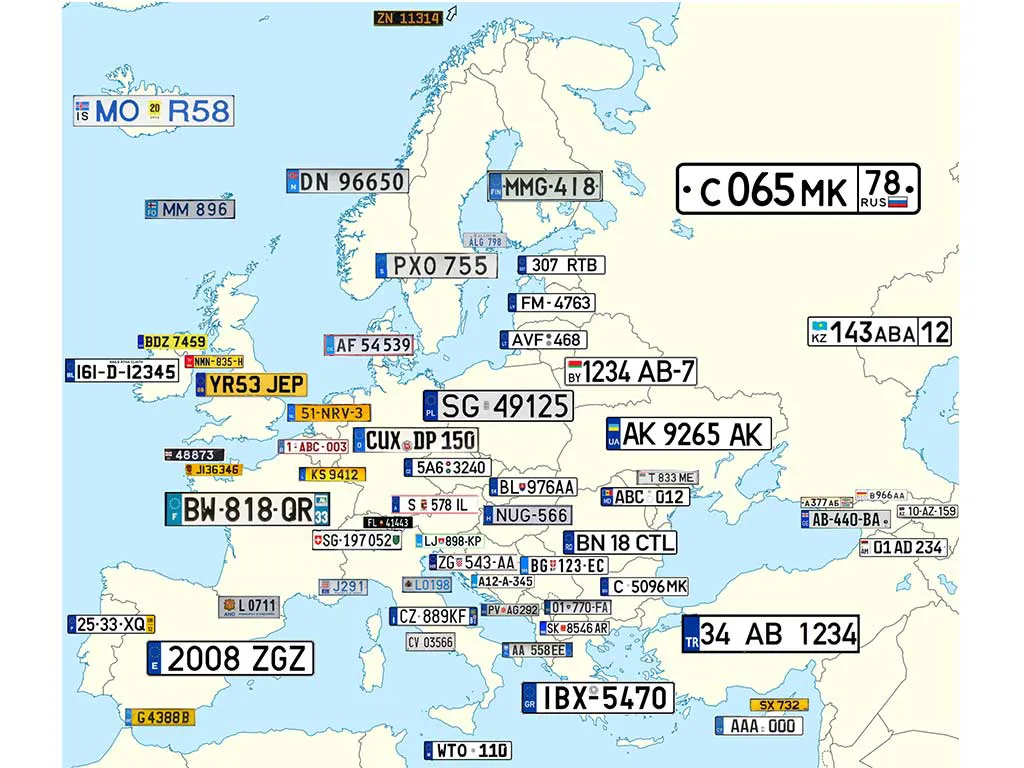

Number Plates of Europe

As more and more owners of British registered motor vehicles are facing the prospect of having their vehicles impounded, the whole issue of when a vehicle should be registered whether from Britain, anywhere else in the EU or from outside the EU is raising its head and causing confusion. Not least for those people who have been driving a foreign registered vehicle for years with no ITV (MOT in the UK) or paid-up road tax and, by implication, no insurance.

You may ask, why highlight British registered motor vehicles? Well, for some years now, the Guardia have been able to access the UK DVLC records via an app on their mobile phones, to check if the vehicle has a current MOT and road tax. No knowledge of English is required as the app is colour coded, green for OK, red for not OK. Having said that, the rules are the same for everybody, regardless of where the vehicle originated.

Let us first look at the exceptions to having your motor vehicle put on to Spanish plates.

Non-residents of Spain resident in another EU country can bring a vehicle registered in another EU country to Spain and can use it (for up to 182 days per year) without paying Spanish taxes. The vehicle must be legal in its country of registration, meaning that it must be inspected (for roadworthiness) as appropriate and taxed there.

A person resident outside the EU may temporarily import a vehicle registered outside the EU for a total period of six months (which need not be continuous) within a calendar year. In certain circumstances, the six-month period can be extended. This applies, for example, to those regularly crossing into EU territory to work, full-time students from outside the EU, and people from outside the EU on a special mission for a specified period. The vehicle can be used only by the owner, his spouse, parents and children (who must also be non-residents). Note, however, that it is necessary for non-EU citizens to have a foreign-registered vehicle ‘sealed’ (precintado) by customs during periods of absence from Spain.

Luck has always played a big part in whether or not foreign registered car owners were sanctioned. The six-month rule, the length of time that foreign plated cars can remain in Spain before being re-registered or taken out of the country has always existed. The rule has nothing at all to do with Brexit although owners of British registered cars may now find they will be liable for Customs Duties and IVA. (Take note of the paragraph below – Transition Period).

The Spanish authorities are well aware that there are thousands of foreign registered motor cars in Spain that should have been registered and that some Brits have been flouting the rules for years. Even so, following Brexit, they are trying to alleviate some of the problems facing some of those people.

Since January 2021, where the owner of a UK registered car can demonstrate via a ferry or tunnel ticket that the vehicle arrived in Spain during 2020, no Duties and IVA are levied. This seems a fair and reasonable approach by the authorities. Alternatively, if the owner has gained residency within the last 12 months or is in the process of doing so, again no Duties and Taxes are payable.

Anyone wishing to import a vehicle into Spain must be a permanent resident, own property in Spain or have a rental agreement for a minimum period of one year and hold a Spanish driving licence.

If you are resident in Spain, registration is mandatory. You have a period of one month from when you become a resident to re-register your vehicle with Spanish plates.

At the moment (July 2021), the procedure for the importation of a caravan or motorcycle with an engine capacity over 49cc is the same as for a car, although mopeds with engines below 49cc can be freely imported as part of your personal possessions and require no special paperwork.

1 Obtain the ITV Card in the Spanish format.

You must take your vehicle to an ITV station for a physical inspection.

You must take the following documentation to the ITV station:

- the vehicle registration certificate from the country of origin

- Certificate of Conformity (CoC) (see Certificate of Conformity below)

- purchase agreement or invoice if you are not the owner of the vehicle recorded in the vehicle registration certificate

- The ITV station will issue and give you the vehicle’s ITV Card in Spanish format.

If the vehicle was not under the current year’s ITV, it must pass the corresponding technical inspection.

2 Payment of taxes

You must declare and pay the taxes related to registration of the vehicle:

- receipt of payment / exemption from / not subject to the Registration Tax payable to the National Tax Office (AEAT) , except in the case of trailers

- receipt of payment or exemption from the Road Tax payable to the municipality where you live. This tax is linked to the power of the vehicle and is paid once a year. Consult your local government to find out how to pay it and the amount.

It is important that you keep your receipt of payment of the taxes.

3 Application from the DGT for registration and the vehicle registration certificate

You can register your vehicle online (Abre en nueva ventana) in the DGT’s electronic register or in person by delivering all the documents to any vehicle registration authority (of the DGT) (Abre en nueva ventana) . In this latter case, you will have to request an appointment (Abre en nueva ventana) in advance. This procedure requires the payment of a fee, which will depend on the type of vehicle you want to register.

To complete this procedure, you must provide the following documents:

- registration application filled out in the official form (Abre en nueva ventana)

- identity document of the vehicle’s owner: an official document that proves your identity and address (DNI [National Identity Document], Spanish driver’s licence, residence card, passport plus foreign resident identification number [NIE])

- the vehicle’s ITV Card issued by an ITV station

- the vehicle’s original documentation from the country of origin

- receipts of having paid the applicable taxes

- proof of the tax address of the vehicle

- if the vehicle was purchased, the invoice or contract of sale.

- payment number or receipt of having paid fee number 1.1 (EUR 97.80) for 2020, applicable to any type of vehicle except for mopeds, for which the fee number is 1.2 (EUR 27.30) for 2020. You can pay at our offices using a credit card but you cannot pay in cash.

If everything is correct, the DGT registers the vehicle, assigns it a registration number and provides you with a vehicle registration certificate.

Once the procedure has been completed, you must go to a specialised shop to buy the registration plates and install them on the vehicle.

If, due to personal circumstances, you do not have time to complete the procedure for registering your vehicle within the one-month deadline, you can apply to the DGT for the temporary registration of your vehicle (Abre en nueva ventana) .

As a result of this procedure, you will obtain green temporary registration plates, with which you will be able to drive your vehicle for 2 months (extendable) while you complete the proper registration process.

You can temporarily register your vehicle with green plates (Abre en nueva ventana) online in the DGT’s electronic register or in person by delivering all the documents to any vehicle registration authority (of the DGT) (Abre en nueva ventana) . In this latter case, you will have to request an appointment (Abre en nueva ventana) in advance. This procedure requires the payment of a fee, which will depend on the type of vehicle you want to register.

To complete this procedure, you must provide the following documents:

- registration application filled out in the official form (Abre en nueva ventana)

- identity document of the vehicle’s owner: an official document that proves your identity and address (DNI [National Identity Document], Spanish driver’s licence, residence card, passport plus foreign resident identification number [NIE]). This is not necessary if you do this through the register

- payment number or receipt of having paid fee number 1.4 (EUR 20.20) for 2020. You can pay at our offices using a credit card but you cannot pay in cash.

- the complete file for the ordinary registration you are carrying out.

Once the procedure has been completed, you must go to a specialised shop to buy the green registration plates and install them on the vehicle. You will then be able to drive the vehicle while completing the final registration process.

When a vehicle is built in the EU, the manufacturers have to conform to EU regulations regarding acceptable build standards and specifications for the entire vehicle and its components. When finished, the vehicle receives a certificate of conformity otherwise known as a CoC or by the unfortunate name, ‘homologation’. For vehicles being imported into one EU country from another this document, or similar, is required so that the ITV stations who will inspect the vehicle can confirm that it is acceptable in their country. A CoC can be ordered through the manufacturer either directly or from a franchised dealer. However, if the vehicle has been changed in any way, the document may not be worth the paper it is produced on.

Optional extras or bolt-ons, such as tow bars, bull bars, running boards, aerofoils etc. are generally not part of the original specification and are fitted after the car leaves the production line. Such items will cause the vehicle to fail its ITV.

To avoid this problem, you need an Engineer’s Report

The Ficha Tecnica Reducida replicates the CoC but can also add the above “bolt- ons” in many cases, so that you end up with a document showing the details of the car as it actually is.

However, components bolted on which are not on the manufacturer’s original specification will not be allowed even if they are on the engineer’s report unless the vehicle is being imported by the person that owned it before he “moved to Spain”. Therefore, a tow bar approved in another EU country can remain on the car only if the owner can prove that the vehicle had this before he brought it to Spain. In most cases this is simple. However, if the owner bought the car after he moved to Spain and the tow bar is not on the original spec’ it has to be removed.

Vehicles manufactured for a market outside the EU will not be EU type approved and a CoC will never be available for such vehicles. An engineer’s report will always be required when these vehicles are imported, even if the vehicle is presently registered in another EU country.

OK, here is where it gets complicated. The best advice is to go to one of the businesses that specialise in re-registering vehicles because the fees and taxes payable vary depending on the age and condition of the vehicle, its original value, where you are in Spain and other factors. Here is a list of the fees you may be expected to pay:

- VAT (IVA) on cars imported from outside the EU or on a tax-free car (on which VAT hasn’t previously been paid) imported from an EU country

- the registration tax depends on the CO2 emissions

- import duty of 10 per cent on vehicles imported from outside the EU unless you are a resident

when importing a new vehicle, you will have to pay VAT (IVA). However, a used car owned for more than six months prior to the owner becoming resident in Spain is not subject to import duty, provided that VAT was paid in the EU country in which the vehicle was purchased

The taxes are applied on the new cost of the vehicle with discounts depending on its age.

One thing is for sure. It will cost you far more if you are stopped by the Guardia Civil for illegally driving a foreign registered car than if you had taken the trouble to re-register it in the first place.

Click here to apply to re-register your vehicle on line

Click here to make your appointment with the DGT

Click here for Registration Application Form

Click here to apply to the DGT for the temporary registration of your vehicle (Abre en nueva ventana)

Location of DGT offices

Spanish Government Administration